About General Provident Fund

-

A subscriber can subscribe towards GPF a sum (in whole rupees) as fixed by him/her, subject to minimum of 6% of emoluments and not more than his/her total emoluments (i.e. Basic Pay+ Grade Pay + D.A.).

-

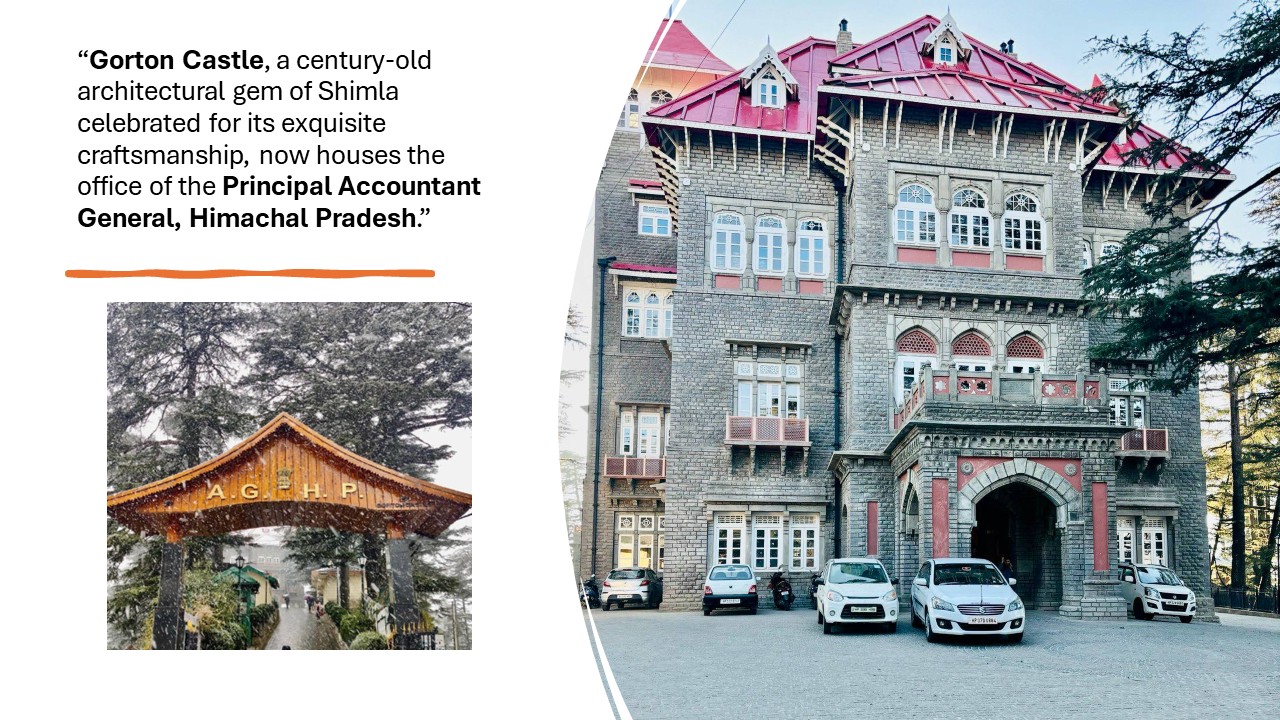

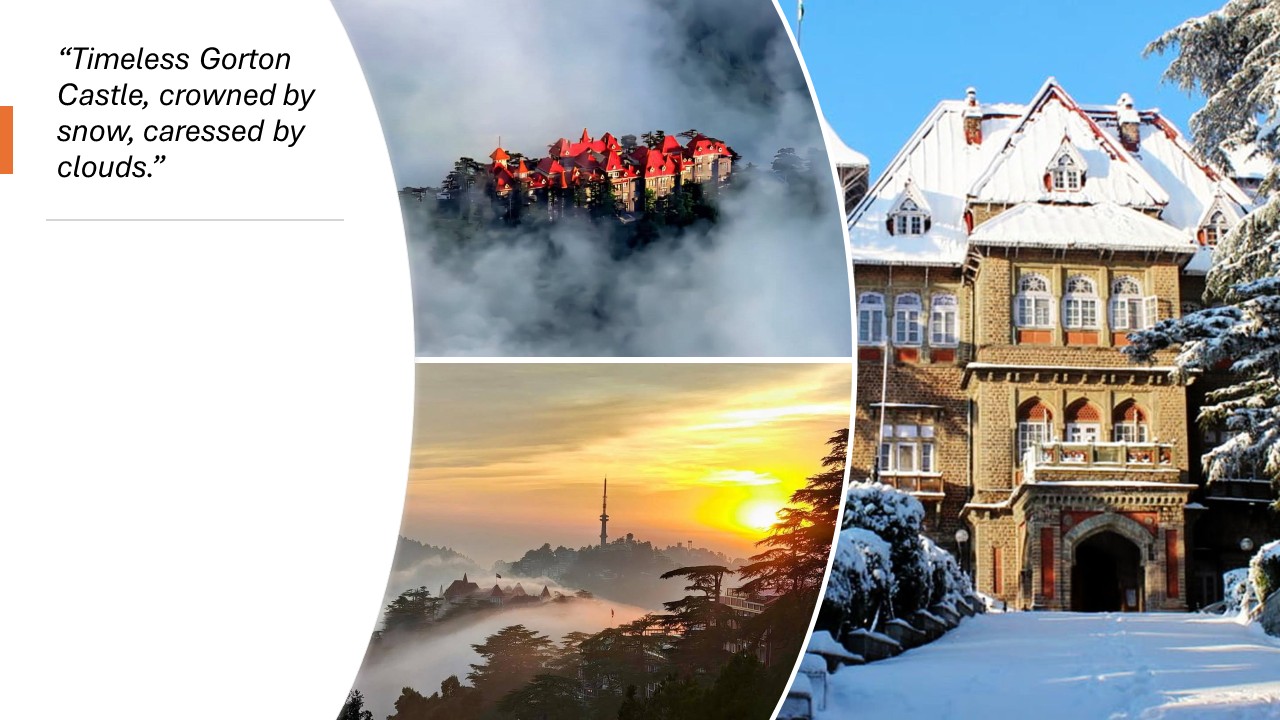

The Principal Accountant General (A & E) maintains the individual GPF accounts including Gr. 'D' staff of around 97000 (Ninety seven Thousand) employees of the Himachal Pradesh State Government as well as All India Service Officers like IAS, IPS and IFS. The Fund group is headed by an I.A. & A.S. officer of the rank of Deputy Accountant General Fund Wing of office of the Principal Accountant General (A&E), Shimla Himachal Pradesh is situated at Gorton Castle Building, The Mall Shimla-171003. This office is also maintaining the retention cases of GPF of the State Govt. retirees.

-

The President of India in consultation with the C.A.G. of India made the G.P.F.(CS) Rules 1960 in exercise of the power conferred by the proviso to Article 309 and Clause (5) of Article 148 of the Constitution of India. These Rules came into force on the Ist April 1960.

About Pension

-

(i)Superannuation Pension(ii) Retiring Pension (iii) Invalid Pension (iv) Compensation Pension (v) Compulsorily Retirement Pension (vi) Compassionate Allowance (vii) Pro-rata Pension (viii) Pension Liability (ix) Service Gratuity (x)Provisional Pension.

-

CCS ( Pension) Rules 1972. H.P. Pre-mature retirement Rules, 1976. All India Services (DCRB) Rules 1958 deals with pension cases of All India Service Officers.

-

As per sub rules (1) and (4) of Rule 61 of CSS (Pension) Rules 1972, the Head of the Office is required to send pension case along with prescribed forms to the office of the Accountant General (A&E) Shimla, six months before date of retirement of the government servant. Thus the pension case should invariably be sent to the office of the Pr. Accountant General/Accountant General (A&E) Shimla, six months before date of retirement of the government servant and following documents should be sent along the pension case:

About Accounts

The Accountant General prepares the Monthly Civil Accounts Appropriation Accounts and Finance Accounts of the State Government from the initial accounts compiled by the treasuries. The first stage of initial compilation is the daily accounting of the individual receipts...