- Home

- About Us

- Functions

- Resources

- Tour Programme

- Publication & Reports

- Contact Us

- Employee Corner

Audit Reports

Financial

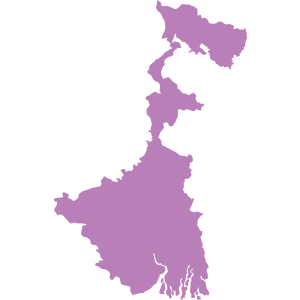

West Bengal

Report No. 2 of 2013 - Financial Audit on Revenue Sector of Government of West Bengal

Date on which Report Tabled:

Thu 10 Jul, 2014

Date of sending the report to Government:

Government Type:

State

Sector

-

Overview

This Report contains 31 paragraphs including three Performance Audits relating to under-assessment/non-realisation/loss of revenue etc. involving RS 530.97 crore. Some of the major findings are mentioned in the following paragraphs: The total receipts of the Government for the year 2011-12 increased to RS 58,755.04 crore against RS 47,264.20 crore in the previous year. Of this, 45 per cent was raised by the Government through Lax revenue (RS 24,938.16 crore) and non-tax revenue (RS 1,340.25 crore). The balance 55 per cent was received from the Government of India as the State's share of net proceeds of divisible Union taxes (RS 18,587.81 crore) and grants-in-aid (RS 13,888.82 crore). As on 30 June 2012, 673 inspection reports issued upto December 2011 containing 2,780 audit observations involving RS 832.52 crore were outstanding for want of response or final action by the concerned departments.

Test check of the records of sales tax, land revenue, state excise, stamp duty and registration fees, profession tax, electricity duty, amusement tax, other tax and non-tax receipts conducted during the year 2011-12 indicated under-assessment/short levy/loss of revenue amounting to RS 1,037.55 crore in 1,409 audit observations. During the course of the year, the departments accepted underassessment of RS 187.02 crore in 716 audit observations pointed out in 2011-12 and recovered RS 83.15 lakh at the instance of audit.