- Home

- About Us

- Functions

- Resources

- Tour Program

- Publication & Reports

- Contact Us

- Employee Corner

- Rajbhasha

- NRA

- RTI

- CPGRAMS

Audit Reports

Compliance

Performance

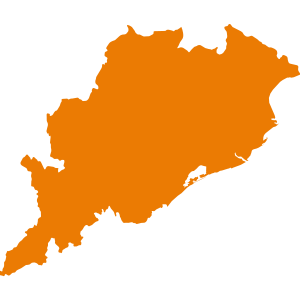

Odisha

Report No. 4 of 2014 - Audit Report on Revenue Sector of Government of Odisha

Date on which Report Tabled:

Mon 28 Jul, 2014

Date of sending the report to Government:

Government Type:

State

Sector

Taxes and Duties

Overview

This Report contains 61 paragraphs and one Performance Audit (PA) relating to non/short lev of tax. interest, penalty, revenue foregone, etc., involving RS 6.195.38 crore. The total revenue receipts of the Government for the year 2012-13 amounted to RS 43,936.91 crore against RS 40,267.02 crore in the previous year. Of this, 52.60 per cent was raised by the State through tax revenue (RS 15.034.13 crore) and non-tax revenue (RS 8,078.04 crore). The balance 47.40 per cent was received from the Government of India in the form of State's share of divisible Union taxes (RS 13,965.01 crore) and Grants-in-aid(RS 6,859.73 crore).

Test check of records of assessment/collection of Value Added Tax including Sales Tax, Entry Tax, Profession Tax etc., Motor Vehicles Tax, Stamp Duty and Registration Fees. State Excise Duty, Mining Receipts during the year 2012-13 revealed under assessment/short-levy/loss of revenue, and other observations amounting to RS 13.428.22 crore in 1,63,150 cases. Audit on "Deduction of Tax at Source from works contractors" revealed the following: TDS and penalty was not effected by the TDAs against the works contractors of 114 works involving payment of RS 1.02 crore. TDS of RS 88.18 lakh was short deducted by 22 TDAs due to application of lower rate of tax and penalty of RS 1.76 crore was not imposed.

Tax, and penalty of RS 1.17 crore was not levied due to incorrect application of Standard Input Output Norm for production of sponge iron against a dealer. Tax, penalty and interest of RS 2.31 crore was not levied treating "cotton yam" as tax exempted goods. Tax and penalty of RS 1.3 crore was not levied on Duty Entitlement Pass Book against one dealer. Penalty of RS 15.96 crore was not imposed on 5542 dealers for non-submission of certified report on the audited accounts within the prescribed period. Demanded Tax and penalty of RS 2.54 crore was not realised from two dealers. Interest and penalty of RS 1.04 crore was not levied against 704 dealers towards delayed payment of tax.