लेखांकन प्रणाली

Structure of Accounts

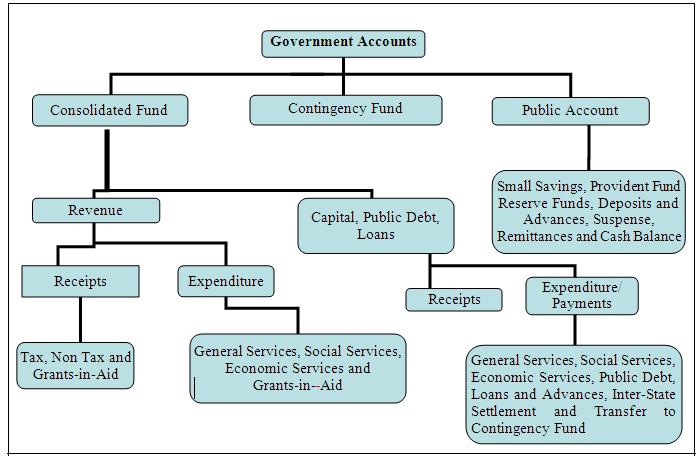

Government Accounts are kept in three parts.

Part-1 CONSOLIDATED FUND Receipts and Expenditure on Revenue and Capital Accounts, Public Debt and Loans and Advances.

Part-2 CONTINGENCY FUND Intended to meet unforeseen expenditure not provided for in the budget. Expenditure from this fund is re recouped

Subsequently from the Consolidated Fund.

Part-3 PUBLIC ACCOUNT Comprises of Debt, Deposits, Advances, Suspense and Remittances transactions. Debt and Deposit represent Repayable liabilities of the Government. Advances are Receivables of the Government. Remittances and Suspense Transactions are adjusting entries that are to be cleared eventually by booking to the final heads of account.

Annual Accounts of the State Govt. are prepared in two parts namely Finance Accounts and Appropriation Accounts.

Finance Accounts

The Finance Accounts depict the receipts and disbursements of the Government for the year, together with the financial results disclosed by the revenue and capital accounts, public debt and public account balances recorded in the accounts. The finance Accounts is prepared in two volumes.

Volume 1 of the Finance Accounts contains the certificate of the Comptroller and Auditor General of India , Summarized statements of overall receipts and disbursements, cash balance position and Notes to Accounts containing summary of significant accounting policies, quality of accounts and Volume II contains detailed statements and appendices.

Appropriation Accounts

The Appropriation Accounts supplement the Finance Accounts. They depict the expenditure of the State Government against amounts `Charged` on the consolidated Fund or `voted` by the State Legislature.