- Home

- About Us

- Functions

- Resources

- Tour Program

- Publication & Reports

- Contact Us

- Working with Us

- Circulars

- Employee Corner

- Women Helpline

Audit Reports

Compliance

Performance

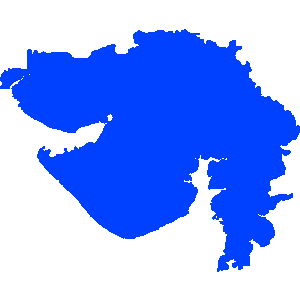

Gujarat

Report No 4 of 2015 - Revenue Sector Government of Gujarat

Date on which Report Tabled:

Thu 31 Mar, 2016

Date of sending the report to Government:

Government Type:

State

Sector

Taxes and Duties

Overview

This Report contains 12 paragraphs and one Performance Audit involving Rs.154.81 crore. Significant audit findings related to major state revenues are value added tax, stamp duty and registration fees, tax on vehicles etc.

The total revenue receipts of the Government of Gujarat in 2014-15 were Rs.91,977.78 crore. The State’s revenue from tax receipts was Rs.61,339.81 crore, non-tax receipts was Rs.9,542.61 crore, State’s share of divisible Union taxes Rs.10,296.35 crore and grants-in-aid from the Government of India were and Rs.10,799.01 crore.

In the Performance Audit of System of registration, assessment and collection under VAT, we noticed the system deficiencies mainly consisted of non-conduct of drive or survey to identify and bring the URDs under tax net, absence of uniform policy for levy and assessment of entry tax and purchase tax, lacunae in notification for remission of tax on sale of oiled/de-oiled cakes of cotton seeds etc. Further, our test check revealed non-levy/short levy of tax to the tune of Rs.124.21 crore in respect of the cases scrutinised by the Department.

Audit of “Registration and safety of school buses, vans, etc. under the Motor Vehicles Act” revealed that the Gujarat Motor Vehicles Department was not in a position to properly monitor the renewal of permits and fitness certificates. It was also unable to curb the menace of overcrowding of school buses/ vans and auto rickshaws despite the restriction of maximum passengers that are allowed to be carried.