AC-DC Bills: Analysis and Dashboards

By Shri Abhishek Singh, Deputy Accountant General

The drawal of contingent charges on items of expenditure by a State Government, for which final classification and supporting vouchers is not available at the time of drawal are made on ‘Abstract Contingent’ (AC) Bills. Initially made as advance, its subsequent adjustments are ensured through submission of Detailed Contingent (DC) bills within a stipulated period of drawal of AC bill. The withdrawal of funds on AC bills on large scale and non-adjustment/ settlement of substantial number of AC bills by way of submission of DC bills by the State Government over the years are a matter of concern and an analysis of the same has been attempted to be carried out on the AC-DC bill dataset through Tableau.

Dataset description

The dataset had details like the AC bill drawal date, amount, DC bills submitted by the DDO, Head of Account classification, pending unadjusted amount etc., The data was available for six years. The data was analysed using Tableau and insights were derived, based on which dashboards were prepared for the continuous use by the office.

Dashboards

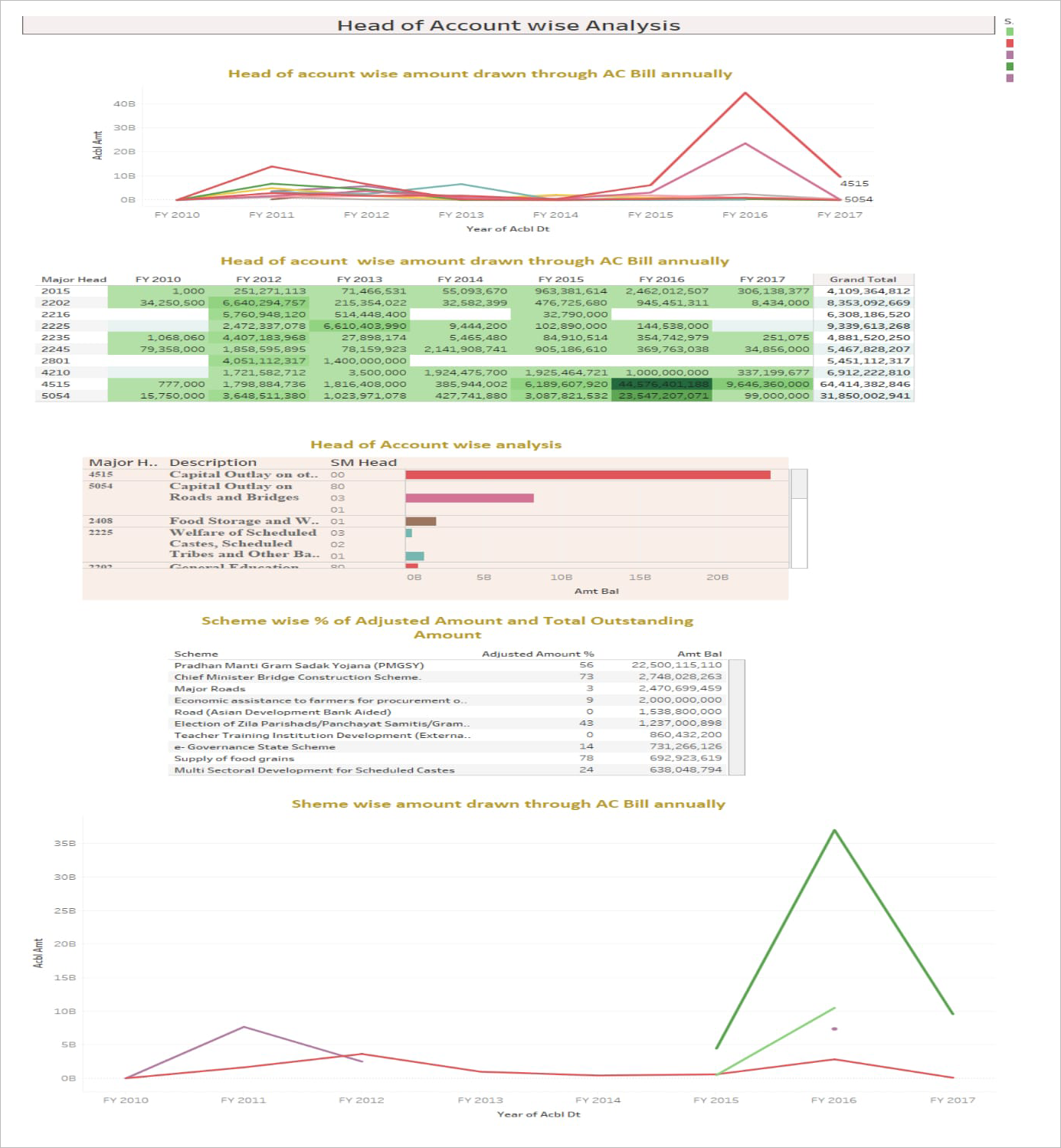

Two Dashboards were made for this purpose – Head of account wise analysis and DDO wise analysis with the help of AC-DC data from the years 2010-11 to 2016-17.

The AC-DC data in an office of the Accountant General (A&E) is captured Major Head wise. Since more than one major head sometimes cater to more than one particular department, it was difficult to have a one to one mapping of the bills drawn with the departments especially when the manner of allocation of expenditure through one major head to more than one department is not clear.

DDOs are the units of activities and an analysis of the AC- DC bills at that level gives an actionable data as well as information for the audit teams to select the units and carry out audit of the same.

Analysis

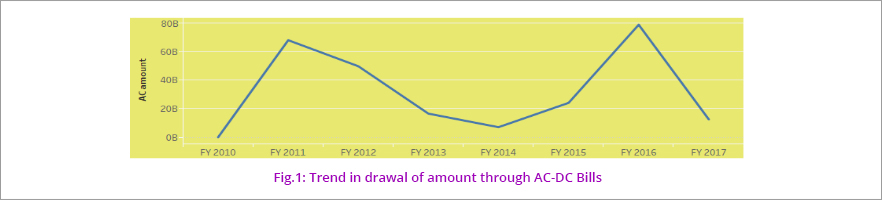

The trend in the drawal through the AC- DC Bill shows a decrease in amount drawn from FY 2011 to FY 2014 which again peaked in FY 2016 to Rs. 78,712,792,126.

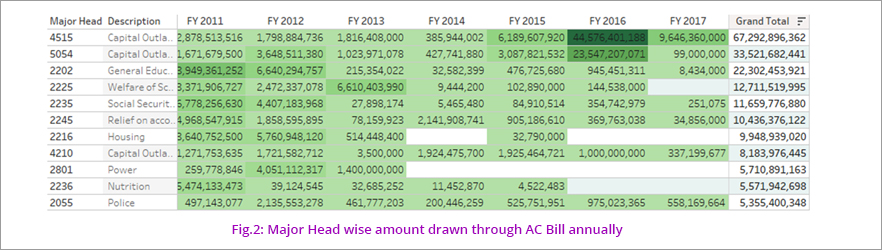

Expenditure through AC Bill should be done only for meeting contingent expenses and not for carrying out planned activities. It is interesting to note that the top two MHs under which maximum AC Bill has been drawn are capital in nature – 4515 (Capital Outlay on other Rural Development Works) & 5054(Capital Outlay on Roads and Bridges)as shown in Fig.2 below.

Expenditure under these MHs should have been planned in advance and AC Bills route for meeting the expenses shouldn’t have been taken. It only indicates lack of object level planning, lack of knowledge about item of expenditure at the time of drawal of amount and tendency to circumvent surrendering of sanctioned amount.

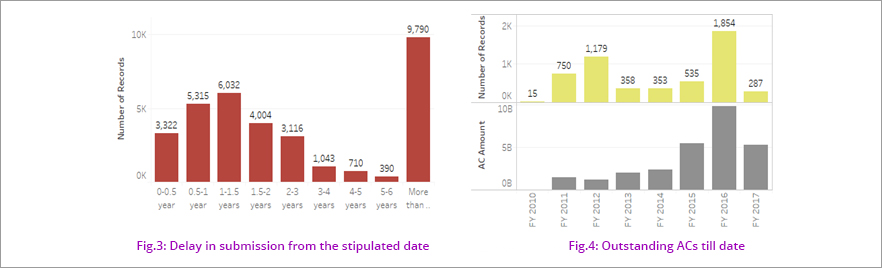

As per general practice, DC bill has to be submitted within 6 months of drawal of AC bill. However, there is a general tendency to delay the submission of DC bill beyond the stipulated date. As can be seen from Fig.3, that maximum number of DC bills had a delay of more than 6 years in submission. Also there were a number of AC bills over the years for which the corresponding DC bills haven’t been submitted till date as shown in Fig.4.

This suggests lack of monitoring and control over the submission of DC bills.

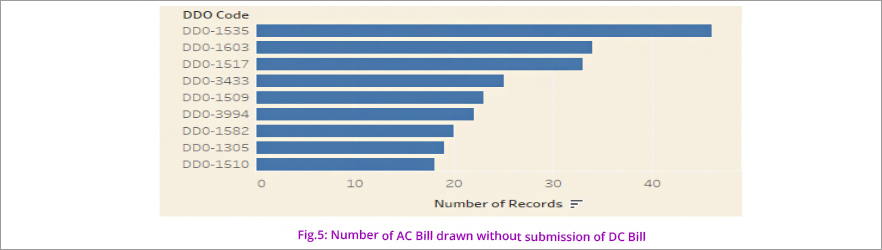

As per financial propriety, in case of outstanding DCs for those ACs which have been drawn six months earlier, Treasuries will not allow further drawal under the same AC. As opposed to this, there have been a number of instances where AC Bill has been drawn without submission of DC Bill (a total of 510 DDOs have allowed drawal of 1999 AC Bills without submission of DC Bills) as shown in Fig.5.

This indicates lack of monitoring and checks at the level of Treasuries in allowing for the passage of such bills. The Treasury Information Management System needs to have a built in check to prevent such types of drawals.

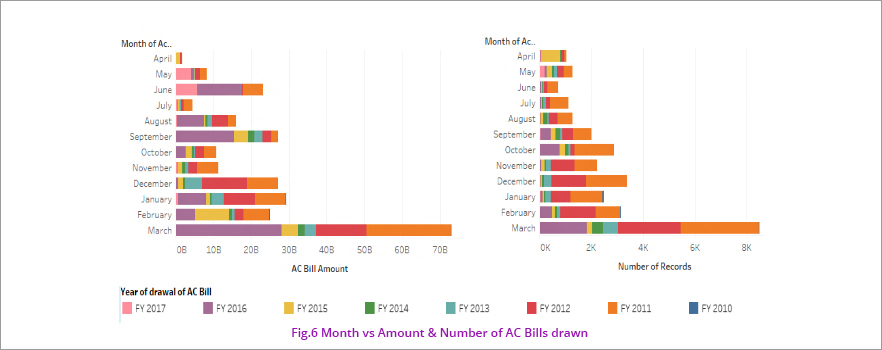

Again as per financial propriety, the expenditure of the government should be spread evenly during the financial year barring some special circumstances where the occasions may arise for an uneven ratio of expenditure. However, a completely different picture comes out as depicted by Fig.6.

Both number of and amount drawn has been high in the month of March particularly in FY 2011 (32.77% of the total amount drawn during that year) and FY 2016 (35.82% of the total amount). Substantial amount of money drawn during the month of March is suggestive of the fact that withdrawls were made merely to avoid loss of appropriations and points towards fiscal indiscipline.

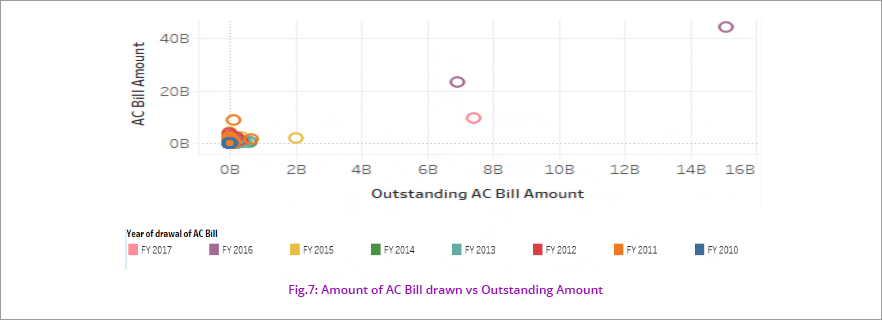

Not only the amount drawn through the AC bills should be kept low, the outstanding amount should also be kept at a minimum. Keeping these two parameters into consideration a scatter plot was made for all the DDOs for the financial years under consideration as shown in Fig.7.

From the plot one could identify the outliers who not only have drawn large amount of money through the AC Bill but also has a large outstanding amount. Such units can be taken up for audit by the office of the Accountant General (Audit).

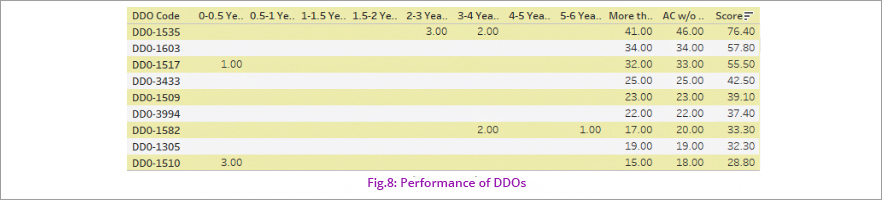

The performances of all the DDOs were evaluated on the basis of delay in submission of DC Bills and drawal of the AC Bill without the submission of DC Bill as shown in Fig.8.

Different weights were allotted to different periods of delay and number of AC Bill drawn without submission of DC Bills. The number of records was multiplied with weights and was added up to obtain the score. Higher the score poorer the performance of DDO and greater the risk factor associated with those DDOs.

Continuous Monitoring through Dashboards

The analysis of AC DC bills show huge numbers and amount drawn through AC Bills, inordinate delay in the submission of DC Bills, rush of drawal through AC Bills in the month of March as well as for works of Capital and Planned nature, and drawal of AC Bill without submission of DC Bill. These insights lead to the conclusion that there needs to be monitoring at the Treasury and DDO level.

Dashboards could now be created to monitor the AC bill drawals, on a continuous basis. An indicative dashboard on Head of account wise monitoring is given in Fig. 9. Similar dashboards could be built for monitoring DDO wise drawals too.

The dashboards can further be updated in subsequent years with respective year’s data being appended to the existing dataset in the dashboard.

Given the increased pace of computerisation and the availability of expenditure and receipt transactions in electronic format, it is only a need of the hour that we, accountants/auditors reinvent our methodologies so as to continue fulfilling our mandate in an efficient and effective manner. Data Analytics is one discipline which can seep through all our activities and improve such efficiency.

|