Emerging PFMTech ecosystem and the Accounting and Auditing functions By Mr. H. Abbas, DG & Mr. Masroor Ahmed, Director

Accounting and auditing, an integral part of Public Financial Management (PFM) cycle.

In general parlance, as per the good practice, PFM practices have five stages in its cycle. They include, fiscal policy and strategy (broadly mandated by the FRBM Acts/Rules and fiscal rules), budget preparation and authorisation (Appropriation and Finance Acts; though States invariably do not have Finance Act), budget execution,accounting and financial reporting and control and audit reporting.

Accounting and financial reporting and control and audit reporting are the last two stages of the cycle and feed into the other stages of the cycle.

PFMTech

As per the Government Accounting Standards and Advisory Board (GASAB) guidelines, the Asset Accounts on Mineral and Non-Renewable Energy are to be prepared by every State. Water Accounting is a systematic study of the status and trends in water supply, demand, accessibility and use in specified domains. The sources of water include surface, ground and soil water. The uses include: agriculture, mining, water supply services, sewerage, industry and household. The water accounting includes: stocks, flows, physical and virtual forms, monetary measurement units.

“Fintech” or Financial Technology is used in the private sector parlance to describe the technology that is aimed at automating and improving the use and delivery of financial services and streamlining digital transactions.

Semblable, in the public sector, both at the Union and the State levels, there is integration of technology and the Public Financial Management (PFM) practices as well as service delivery. If we concede to call it PFMTech, then PFMTech is now underpinning service delivery, procurements, financial management, payments, receipts, accounting and financial reporting by governments in India.

One may look at the state of play between the financial transactions of the governments in India and PFMTech at two levels.

One, in terms of, what Richard Musgrave18 would say, distributive functions, such as service delivery, direct benefit and cash transfers, different citizen-centric welfare schemes as well as employees-related benefits, payment for goods and services procured. In addition to these, both the Union Government and the State Governments are using PFMTech also for collection of direct and indirect taxes as well as for receipt of non-tax revenues such as fees, fines, interests, dividends, royalty, etc.

Two, in terms of accounting, documentation and record-keeping and financial reporting. If one looks at the budget – payment – accounting – reporting spectrum and map the impact of PFMTech, it can be seen that each aspect of the spectrum is being managed through PFMTech.

Different steps, from budget-making to payment, involved in the spending process are being managed digitally, on-line with system validation and electronic authentication.

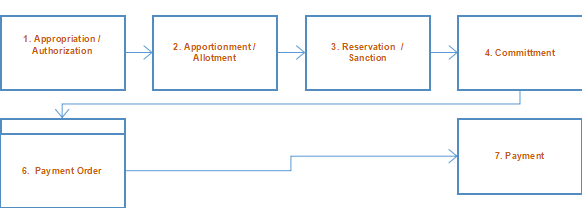

The figure given below presents steps involved in payment process, from budgeting to payment. Steps 1 to 3 relate to authority to spend, 4 and 5 to incurrence of obligation and 6 and 7 to clearance of obligation by the Government.

Figure 1: stylized depiction of spending process

An adequate understanding of these steps, access to transaction data and information and evidentiary documents (including e-documents) is sine-qua-non for transactions audit, which we generally, refer to financial and compliance audit, conducted either together or separately.

Under the National e-Governance Plan (NeGP), states are implementing Integrated / Centralised Financial Management System (IFMS/CFMS), also designated as e-Kosh (Chhattisgarh), e-Khazane II (Karnataka), HimKosh (HP) or similar terms with different modules to take care of all the stages of the payment process, including budgeting, allotments, sanctions, purchase orders, vendor management, verification of delivery of services and goods and issue of payment order (NEFT/RTGS/e-Payment).

They are also implementing receipt management module through e-GRAS (electronic Government Receipt Accounting System) for State Own Tax and Non-Tax revenues (Other than State GST, which is through GSTN).

Howbeit, the adoption of digital / electronic mode is not at the same stage in the States; they are at different levels of maturity in implementation of different modules of the system.

The following table provides a snapshot of maturity level of IFMS / CFMS implementation.

| Modules | Status19 |

| Treasury Computerisation / Online bill (DDO2Try2Bank) | Implemented: in all States except, Under Implementation: Sikkim. Not Implemented: Arunachal Pradesh and Nagaland |

| e-Budget (Budget and Appropriations) | Implemented: in all States except, Under Implementation: Maharashtra, Meghalaya, Sikkim and Tamil Nadu. Not Implemented: Arunachal Pradesh and Nagaland. |

| Accounts / Treasury (Flow of accounting data to AG) | Implemented: in all States except, Under Implementation: Sikkim. Not Implemented: Arunachal Pradesh, Gujarat and Tamil Nadu. |

| e-Payment (NEFT/RTGS etc.) | Implemented: in all States except, Under Implementation: Maharashtra, Meghalaya, Sikkim and Tamil Nadu. Not Implemented: Arunachal Pradesh and Nagaland. |

| e-Sanction (electronic sanctions) | Implemented: Assam, Karnataka, Mizoram, Odisha and WB Under Implementation: Andhra Pradesh, Haryana, HP, Kerala and Meghalaya. Not Implemented: Rest |

| e-Voucher (digitally signed electronic voucher) | Implemented: Andhra Pradesh Bihar, Haryana, Kerala, MP, Mizoram, Odisha, Rajasthan and Uttarakhand. Under Implementation: Assam, Chhattisgarh, HP, J&K, Maharashtra, Punjab, Tamil Nadu, Tripura and West Bengal. Not Implemented: Rest |

| e-Receipt (Online management of non-SGST, State Own Taxes and Non-Tax Revenue) | Implemented: in all States except, Under Implementation: J&K, Mizoram, Sikkim and Telangana. Not Implemented: Arunachal Pradesh and Nagaland |

| e-HRMIS / Payroll (Human Resources and Payroll) | Implemented: in all States except, Under Implementation: Assam, Meghalaya, Nagaland and Sikkim Not Implemented: Arunachal Pradesh, Gujarat, Manipur and Rajasthan. |

| RBI e-Kuber onboarding (electronic payment through RBI) | Implemented: in all States except, Under Implementation: Gujarat, Haryana, HP and Maharashtra. Not Implemented: Arunachal Pradesh and Nagaland. Not with RBI - Sikkim |

Antecedents: Treasury computerisation and VLC system

Even before implementation of the IFMS / CFMS by the States and parallel to the Voucher Level Computerisation (VLC) system by the AG Offices, about more than 25 years back, States started computerisation of Treasuries and online billing. For example, Himachal Pradesh (1991), Rajasthan (1996-97), Kerala (1998), Assam, Chhattisgarh, Haryana, Karnataka, MP, Maharashtra, Punjab, UP (2001-04) started treasury computerisation.

It is also noteworthy that starting with the 6th Finance Commission (1973), 7th, 8th, 9th and 10th (1995) Finance Commissions emphasised on the computerisation of district treasuries for improving the managerial control of both the State and District level administration and for speedy and accurate generation of accounting information20.

To respond to the then emerging treasury computerisation scenario in the States, the subject of developing an accounting software for AG Offices (VLC) was deliberated in the AG Conference in 1996 and Action Plan was put in place for VLC in 1997-2000.

As such, implementation of the VLC at the end of 1990s and in early 2000s was a state of the art system for compilation and financial reporting with voucher / challan level data.

Government of India’s PFMS

The Government of India has implemented Public Financial Management System (PFMS) since 2009. PFMS, as a platform, amongst others, caters to the important aspects of public financial management process. They include dealing with employee’s payroll and employee benefit payments of the Central Ministries and Departments and transfers of funds and grants to Central agencies and the States. The latter, especially for Centrally Sponsored Schemes (CSSs), including now for fund transfer to and monitoring of utilisation by the Single Nodal Agencies (SNA) designated for the CSSs.

The Government of India has also implemented BHARATKOSH for non-tax receipt management. Union Government’s eGramSwaraj is part of the PFMS dashboard as accounting application for Panchayati Raj.

RBI’s payment mechanism: e-Kuber

e-Kuber is a core banking solution of the Reserve Bank of India (RBI) since 2012, which acts as an online / electronic payment mechanism for government’s transactions and service delivery. It is also used for GST settlements and for auction of sovereign gold bonds and government securities.

Indirect Taxes: GSTN and CBIC

Goods and Services Tax Network (GSTN) and Central Board of Indirect Taxes and Customs (CBIC)’s Automation of Central Excise and Service Tax (ACES) are the core applications, which are presently dealing with GST collections (CGST, IGST and SGST) and GST related services. It is understood that ACES shall be integrated / merged with the GSTN soon.

Direct Tax’s Income Tax Business Application (ITBA)

For management of direct taxes, Government of India has implemented ITBA 1.0 and ITBA 2.0 is under implementation.

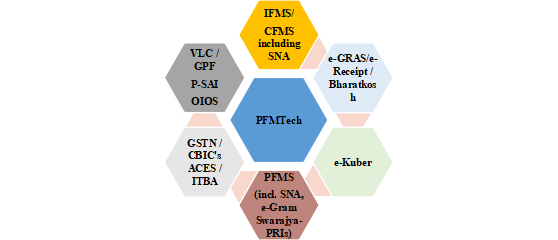

The following figure present the prevailing and emerging ecosystem of PFMTech

Figure 2: stylized depiction of prevailing / emerging PFMTech

Our Response

Apparently, the prevailing / emerging PFMTech ecosystem warrants adequate and timely response in terms of information system facilities and infrastructure from Indian Audit and Accounts Department (IA&AD).

On accounting and entitlements side, a response similar to VLC vis-a-vis treasury computerisation as in 1990s/2000s is needed for leveraging the opportunities and meeting the challenges.

- The PFMTech offers a chance to interface VLC system with external systems for availability of information in timely manner and on near real-time basis.

- It also offers the opportunity to receive, validate and process data and e-signed documents (voucher, sanction, budget, re-appropriation orders, etc.) online and do away with manual intervention.

- However, to take advantage of the opportunities, the VLC system needs to be re-designed with business process re-engineering (BPR) ready to interface and communicate with the external systems.

- VLC system in the present form is (i) meant only for manual data entry and cannot receive electronic data from external source; (ii) as a data repository and not for storing or allowing retrieval of electronic documents; (iii) contains several repetitive an redundant processes and requires BPR; and (iv) is not aligned with / responsive to the requirements of the external platforms / systems.

- With implementation of eHRMIS / e-Payroll and e-Service, there is need for upgrading the pension system (PSAI), GPF system and gazetted entitlements system (GEMS) to enable them to communicate with the information and documents available in the eHRMIS / e-Payroll and e-Service.

On the audit side, the twin requirements are auditing the external PFMTech systems and auditing by using the system.

- It is understood that at present, out of the 28 States and 2 Union Territories (Delhi and J&K), IT audit of the IFMS has been completed in 11 States; is under progress in 9 States/UT and yet to be taken in the rest.

- In the States, IFMS/CFMS can be used for financial audit of the State accounts, audit of sanctions, etc, and compliance audit. For performance audit, information on schemes, programmes, projects, procurements, human resources, payroll, etc., shall be available in the system

One IA&AD One System (OIOS)

OIOS implemented by the IA&AD is an end-to-end audit process automation and information management system. For using the information in the VLC system for referencing audit universe and for risk analysis and audit planning, OIOS needs to interface with the VLC. Also, for voucher audit and financial audit, OIOS needs to use VLC system.

On the other hand, OIOS also needs to interface with external PFMTech systems.

OIOS is also being used for treasury inspections. Office of the AG (A&E) Punjab did pilot treasury inspection through OIOS in 2023 and has implemented treasury inspection through OIOS. Offices of the AG (A&E) Haryana and Odisha are conducting pilot treasury inspection through OIOS.

Status of VLC upgrade and end-to-end digitisation of entitlement functions

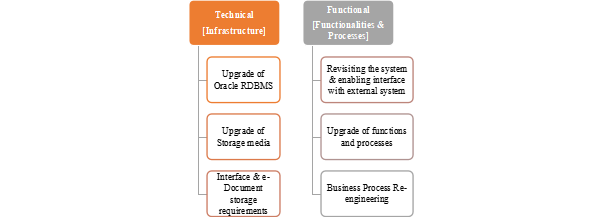

VLC upgrade has twin requirements, technical upgrade and function upgrade. Assessment study for technical upgrade is underway and is targeted in 2024-25. Technical upgrade is meant to upgrade IT infrastructure and facilities such as storage media, Oracle RDBMS, etc.

Functional upgrade is meant to revisit the VLC functions and processes, undertake BPR, enable interface with the external systems, etc.

Figure 3: stylized depiction of VLC twin upgrades

For taking advantage of the opportunities and meeting the challenges with regard to the entitlements functions (pension, GPF and GE) vis-à-vis the PFMTech interface on the one hand and for enabling the availability of authorised orders (e-PPO/e-GPF etc.) at the DigiLocker, on the other, there is a requirement of technical upgrade (P-SAI, GPF, GE) in the shorter term.

“Every new thing creates two new questions and two new opportunities”21. Seems we have twin questions and twin opportunities and we should deal with them and take advantage of.

And also, let us agree with Charles Darwin that “it is not the strongest of the species that survives, nor the most intelligent, but the one most responsive to change”.

- 18. Richard A. Musgrave & Peggy B. Musgrave: Public Finance In Theory And Practice, McGraw-Hill, 5th Ed., 1989 (first published 1973)

- 19. Status as in May 2024: collected through AG Offices.

- 20. Barua, Mithun: E-Governance in the Government Treasuries in India – A Critical Evaluation, International Research Journal of Social Sciences, Vol. 1(3), November 2012, pages 45 – 50 and Finance Commission Reports.

- 21. Margaret Wheatley (Author and Leadership and Systems consultant).

Continue Reading

From the Editor's Desk

Forty years ago, recognising the knowledge driven nature of our Institution, the quarterly publication of the “Journal of Management and Training” was initiated....

Reporting for impact - Improving readability of audit reports

The need for enhancing the value and impact of CAG’s audit has been an enduring concern...

Application of Machine Learning Algorithms in Audit

There has been a tremendous explosion of data available with public sector entities over the last 20 years...

Digital Accountability: Harnessing Photo Forensics for e-Services Audits

In an era where technology intertwines with governance, the shift towards online portals for delivering public services has been monumental...

Accessibility of Cutting-Edge Technologies in GIS and RS

The democratization of cutting-edge technologies such as Geographic Information Systems (GIS) and Remote Sensing stands as a huge shift, empowering...

Beneficiaries of Social Schemes and Assessment

Social programmes have evolved over the decades, aiming for increased coverage, higher entitlements, and better design by using technology for targeting...

Blue Carbon Accounting

Human beings thrive in diverse ecosystems but often simplify these ecosystems over time. This simplification occurs through targets...

Generative AI: The Age of Artificial Imagination

In the vast landscape of artificial intelligence, few innovations have captured the imagination of the humans and sparked as much excitement as...

A 1.5-year-old DAG in a 150-year-old Institution

It was on 14th December 2022 when our posting orders came while I was still attached as an Assistant Director in the CRA Wing in the Headquarters Office, New Delhi....