Issues in Land Management in Kerala

Dr. Biju Jacob, IA&AS, AG (ERSA), Kerala and

Shri I.P.Arun, Sr AO, Office of AG(ERSA), Kerala

"We abuse land because we regard it as a commodity belonging to us. When we see land as a community to which we belong, we may begin to use it with love and respect."- Aldo Leopold.

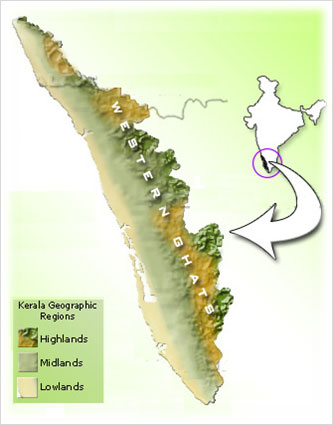

Land is the fundamental natural resource for developmental activities. Hence, the demand for land has multiplied several times. Like other natural resources,  the limited supply has caused severe pressure on the available land. This has become very serious in Kerala due to its small size- 38,86,287 Ha. (38,863 Sq Km) - 1.18 per cent of the total area of the country. Out of this 11,309.48 sq km – 29 per cent – is forest land. Among the three physical divisions of the State – highlands, midlands and lowlands -the land available for developmental activities is limited to the mid and low lands. This has further increased the pressure and land has become a precious commodity with sky high prices.The total land can be classified into three - Government land managed by Revenue department, Forest land by Forest department and private land of individuals, institutions, PSUs, companies and autonomous bodies. the limited supply has caused severe pressure on the available land. This has become very serious in Kerala due to its small size- 38,86,287 Ha. (38,863 Sq Km) - 1.18 per cent of the total area of the country. Out of this 11,309.48 sq km – 29 per cent – is forest land. Among the three physical divisions of the State – highlands, midlands and lowlands -the land available for developmental activities is limited to the mid and low lands. This has further increased the pressure and land has become a precious commodity with sky high prices.The total land can be classified into three - Government land managed by Revenue department, Forest land by Forest department and private land of individuals, institutions, PSUs, companies and autonomous bodies.

The Acts and Rules give sufficient power to conserve and manage the land– including private land – in public interest. However successive Governments failed to safeguard the public interest and powerful individuals /social groups could amass vast tracts of land violating the rules.

The development of a private airport at Aranmula violating all land laws and the Government allotment of land for a foreign developer for an IT Smart city added new dimensions to the complexity.

Hence, a performance audit on land management by the Government of Kerala for the period 2008 to 2013 was conducted by AG (ERSA). The data/information collected were analysed with reference to the audit criteria and findings of Audit were discussed with the Department and Government.

A unique multi sectoral report

The topic land management was planned for 2013 -14 in the three sectors under the audit jurisdiction of AG(ERSA) viz – Revenue, PSU and Economic Sectors – to consolidate it into one common report.

- Revenue Sector – Government land, forest land and Airport project

- PSU sector – Private land acquired by three PSUs

- Economic Sector – Smartcity, Kochi under IT department

This was made possible due to the sectoral reorganisation of IA&AD; where these three sectors converged in AG(ERSA).

The report "Land Management by the Government of Kerala with special focus on land for Aranmula Airport and Smart City Kochi" (Report no:6/2014) was placed in the Kerala legislature in July 2014.

1. Management of Government land

Total absence of centralised information on Government land by the revenue department was the major hurdle.The information on land – such as survey number, sketch etc. is kept in 1,634 village offices spread all over the State. Each village had three sets of land records viz. Settlement register, title deed register for private land and Government land register. Audit had to be limited to a sample of 25 villages belonging to 16 out of 63 taluks in seven out of 14 districts including the Commissionerate of Land Revenue,Thiruvananthapuram.

Land Bank – Side-lining the best practice, the mission failed to take off

The attempt of Revenue & Disaster Management department to form a Land Bank was a best practice followed by the Government/Department. Land Bank is a repository of details of Government land, for scientific inventorisation and professional management of land in the State. The innovative approach was aimed at preparing comprehensive information of saleable Government land to landless people with focus on development of rural areas. It also aimed at promoting commercial establishments and curtails the activities of land mafia and speculative price hike of land. Though the procedure of inventorisation commenced in 2007, the department was not able to take stock of the land even by 2014.

The absence of centralised information is exposed to the risk of possible encroachment of Government land. There were several instances of encroachments in Government lands in the test checked villages.

Revenue department as the custodian of Government land failed to follow the land management policy laid down through various orders and circulars. The department also failed to identify and account for Government land, monitor the use of leased out land, plug violations of lease conditions and collect lease rent regularly. There was no system for periodical renewal of lease and revision of lease rent.

The Government land was under continuous demand from different socio-political pressure groups and powerful individuals and successive Governments assigned/leased large tracts of land under different schemes.Since these assignments were done under the directions of the Cabinet, the Government Secretaries were reluctant to produce the records; which was the second major hurdle in the audit. However the files were obtained through constant contact.

There were several instances of illegal occupation too. The department not only failed to prevent alienation of Government land but abetted the encroachment. Audit noticed such short comings in respect of 338. 60 Ha of land which had a financial impact of ₹ 1,077.74 crore.

2. Management of forest land

Considerable area of forest land - 1,19,178.88 Ha was given on lease to Public Sector Undertakings. Audit was conducted in Forest headquarters, three territorial circles and five divisions where large areas of forest land were leased out.

Like the Revenue department, the Forest Department did not have consolidated records of land on lease. The absence of proper records helped to retain 9.63 Ha of forest land in 'the Alwaye Settlement Colony' under the jurisdiction of Chalakkudy Forest Division. The department also failed to check violation of the lease conditions and to act upon in cases of such violations.

In order to facilitate regulation of land and utilisation of resources, there is a need to critically maintain a data base.

The department failed to collect lease rent arrears of ₹ 196.85 crore in 140 cases in respect of 42,130.49 Ha of leased forest land. Though the lease rent was to be revised every three years, it remained unchanged since 1990 and the lessees paying a nominal lease rent at the rate of ₹ 1,300 per Ha per annum causing loss of revenue.

Periodical revision of lease rent is an essential ingredient in revenue mobilisation.

Vast areas of forest land were leased out or given as grants by the former Maharajas of Travancore and Cochin to private individuals and the forest department failed to monitor such cases. 35.18 Ha of forest land in Forest Division Chalakkudy was sold several times in violation of the rule that Government land on lease cannot be transferred by way of sale. In one case the last occupant availed two loans for ₹ 85 lakh mortgaging such property. The illegal mortgage of forest land and non-repayment of loan had doubled the magnitude of irregularity. A similar instance of transfer of 389.34 Ha of leased forest land was noticed in Forest Division Thrissur. The forest department failed to initiate resumption procedure against alienation of Government land in violation of lease rules. Total financial impact of audit observations in this regard amounted to ₹ 215.46 crore.

The essence of monitoring mechanism typically involves managing public land records and registers to determine the lease rent due, defining land use and support development initiatives.

3. Acquisition, development and allotment of private land for industrial purpose by PSUs

Audit also examined the records relating to the acquisition, development and allotment of land for industrial purpose by three PSUs viz. KINFRA, KSIDC and KSITIL. These PSUs had acquired 5003.78 acres of private land under Land Acquisition Act, 1894 at a cost of ₹ 763.74 crore.

Impact of acquisition of land for industries

Acquiring agriculture land for unjustified industrial activities and for creating infrastructure ended up in drastic fall in cultivable land. The richer section found it convenient to develop the agricultural land for construction of building for commercial uses and improvement of infrastructural facilities necessitated conversion of large area of cultivable land.

This was made possible due to the sectoral reorganisation of IA&AD; where these three sectors converged in AG(ERSA).

There was wasteful/extra expenditure on acquisition/development, purchase of land at exorbitant price and extending undue benefit to private sector companies. Out of the total land; 2,290 acres were allotted to 558 persons and the balance is yet to be allotted. Even though the allotments were at throw away prices; 41 persons did not utilise (March 2014) the allotted land measuring 180.57 acres defeating the very objective of setting up of industrial units.

INKEL – a private company – obtained several undue benefits including 60.95 acres of land and became a major player in the land development activities in a short span. Kerala State Industrial Development Corporation ( KSIDC) acquired a total area of 1096.12 acres of land for setting up of four Industrial Growth Centres (IGC) out of which 447 acres was allotted to entrepreneurs. Of the 258 acres of land acquired for IGC at Malappuram, 243.79 acres remained vacant for 12 years due to non-creation of infrastructure by KSIDC. The joint venture partner(INKEL) was allowed to possess 60.95 acres of land through sub-lease.The MD of INKEL who decided to transfer 60.95 acres of land was simultaneously holding the position of Secretary of Industries Department .

The financial impact of deficiencies noticed in the acquisition, development and allotment of land by the PSUs amounted to ` ₹ 212.02 crore.

4. Issues in respect of land and ecological impact – Aranmula Airport

GoK approved a Greenfield airport by the private developer KGS group in the World heritage site of Aranmula village in September 2010. The proposed one was the fifth airport in the small State of Kerala having a length of 580 km. There were widespread protests citing gross violation of land laws and environmental impact. Being a totally private airport without any Government stake, audit focussed on the land issues of the project.

As far as the Aranmula Airport project was concerned, four village offices, Taluk office – Kozhenchery, Taluk Survey office – Kozhenchery, Collectorate – Pathanamthitta, Taluk Land Board –Kozhenchery and Commissionerate of Land Revenue, Thiruvanathapuram were selected for audit. Audit also test checked the Government files in the administrative departments viz. Transport, Industries, Revenue and Environment at Government Secretariat.

The land belonged to an individual Shri Abraham Kalamannil who had illegally possessed 153.31 Ha – including Government land – which was more than 25 times the ceiling limit prescribed by the Land Reforms Act. He sold a major part (94.94 Ha) of the land to KGS group; retaining the balance 58.37 Ha with him. The Company purchased additional 39.9285 Ha of land, encroached 24.35 Ha of Government land and is currently in possession of a total of 159.22 Ha. The individual and the company are in possession of 217.59 Ha of land violating six land laws.

The departments favoured the industrialist to take hold of land without following due procedure.

The Revenue department right from the lowest revenue officials to the highest level failed to prevent or take action against encroachment of Government land, filling of paddy fields, illegal acquisition of land etc. enabling the individual to hold excess land and to transfer a major part of it to the Airport Company. Registration department permitted to alter the nature of land and boundaries in the sale deeds in respect of 19.05 Ha of land at the time of registration.

Once the land was transferred to the airport company the industries, transport and the environment Secretaries supported the airport project violating the financial and administrative rectitude.

Even though the Transport department was the nodal department for the project, the Industries Secretary over-stepped the jurisdiction, accepting the application for NOC from the airport company and granting in-principle approval without conducting sufficient verification regarding the land with the developer and the impact of the proposed airport on the airports existing/under construction.

Industries department declared 444.72 Ha as industrial area, based on a claim of the company without the knowledge of the Revenue department. The estimated requirement of land for the airport was only 200 Ha and the company held only 159 Ha at the time of declarations. Thus the Industries department helped the company classifying large extent of land as industrial area to help the company.

The Government's decision to accept shares of the company cast suspicion over its involvement in land deal by unfair means.

The transport department accepted 10 per cent equity offered by the airport company free of cost and the airport became a joint venture between GoK and KGS Group Chennai and Government became a partner to all the illegal activities of the company.

Environmental department submitted false information to Government of India regarding the objections raised by Legislative Committee on the project, farmers apprehension against the reclamation of paddy field etc. and helped the company to obtain environmental clearance for the project. Audit has recommended an independent enquiry to investigate the issue.

5. Smart City Project, Kochi – A unique audit approach

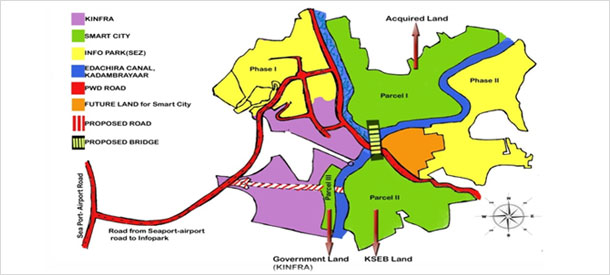

Govt of Kerala launched a Special Purpose Vehicle (SPV) termed Smart City (Kochi) Infrastructure Pvt. Ltd., with Dubai Internet City (DIC), a subsidiary of TECOM Investments FZ LLC, Dubai (Tecom) for setting up knowledge based IT township in Kochi. GoK leased out (in 2007 and 2008) 246 acres of land to SPV for 99 years for a one time lease premium of ₹ 104 crore and had a limited stake of 16 per cent in the SPV. The balance 84 per cent was held by DIC. This was projected as a mega project to transform Kerala into a major IT destination within 10 years and generate 90,000 jobs in 8.8 million sq.ft built up space.

Audit Challenge

The principles of transparency, discreet and far-sighted governance were sacrificed for ostensive reasons like development of IT industry, providing jobs to pro-poor etc. In the bargain, the developers got hold of a great deal of land. Since the Government stake was limited to 16 per cent, we excluded the implementation of the project and focused on four areas were the public interest was affected.

- Transparency in the selection of partners

- Land issues

- Loopholes in agreement

- Future liability of Government

Hence the records regarding the initial discussions, the Memorandum of Understanding (2005), the Framework Agreement (2007), lease deeds, orders issued by various departments of Government of Kerala/India with reference to Smart City Project, financial statements of Special Purpose Vehicle for five years from 2007-2011, adherence of Special Economic Zone Act, 2005 for the project were scrutinized.

The nature of Frame Work Agreement (FWA)-which defined the role of parties-, was ambiguous as it was neither a contract nor a PPP project; but at the same time, the project retained all the characteristics of a PPP project. Considering the very minor stake of GoK in the SPV; Audit focussed on the FWA agreement to examine whether public interest was safeguarded adequately. The audit conducted in 2013 - seven years after the launch – revealed that the project has not at all progressed and that the SPV was not bound to spell out a time frame due to the deficiencies in the FWA.

There was total lack of transparency right from the conceptualisation stage about the justification for a Smart City and the need for creation of a new SPV. The partner for the project was selected in an exhibition at Dubai. The selection was not transparent and was done without giving opportunities to other players in the field. The past track record of partner was also not considered.

The attempt by audit brings out the mismanagement of land by a foreign developer in which the Government was a facilitator. The report exemplifies the allotment of land on long term lease in an arbitrary manner to private entities without any return to safeguard the social interests. The deal was distinctive as the lessee was granted free hold rights over 12 per cent of the total area of the land under their possession at any point of time.

Government transferred 246 acres of land in three parcels- parcel 1 of 131.41 acres, parcel 2 of 100.65 acres and parcel 3 of 13.94 acres- on lease without properly assessing the land required for the project and had committed to acquire and hand over additional land for the project in future. The valuation of land for fixing lease rent was much below as compared with the land value considered for registration of land of the adjoining areas.

Proposed Site of Smart City Project

Though the project could be commenced in parcel I (131 acres) with the attainment of developer status in 2008, the SPV delayed the project insisting for SEZ status for the entire 246 acres of land. Unlike other IT parks established by Government, the lessee was granted freehold rights over 12 per cent of the total area of land under their possession at any point of time.

The authority to command compliance was only a mute spectator in decision making process.

GoK had only two nominees – IT Minister and IT Secretary - in the ten member Board of Directors of the SPV. The quorum for Board meetings was set at five – with at least three from DIC and one from GoK ; and all decisions could be taken by a simple majority of Directors present and voting. Thus DIC could overrule GoK in all significant decisions.

Illogical penal provisions hinder the administration of agreement conditions, helping the developer to prolong the commencement of the project at the discretion of developer.

The strict penal provisions to ensure creation of 90,000 jobs envisaged in the negotiations diluted in the FWA agreement and SPV could escape from its commitments to generate jobs. Remedies for non performance were totally in favour of DIC and were against the interests of GoK. Heavy liability was cast upon GoK for defaults in providing minimum infrastructure; it was not possible against DIC for lack of co-operation in this regard. As a result, the SPV was totally indifferent to the project thereby delaying Government's efforts in providing minimum infrastructure that it was supposed to do.

Non-transparent decision renders non fulfilment of objective of setting up of a knowledge based IT/ITeS township in Kochi while GoK loses prime industrial land.

Neither the Government nor the SPV had spelt out any precise timeframe to operationalise the project. Even after seven years from signing the agreement, construction of 8.8 million sq.ft. built- up space and creation of 90,000 jobs are far from sight; though the foreign partner had obtained 246 acres of land at a throw away price.

6. Conclusion

Land management involves activities on land and natural resources such as land allocation, land use and planning. A need based allotment /acquisition only can salvage the scarce resource.GoK had failed miserably in managing the limited land- one of the most important natural resource – in public interest. Successive governments succumbed to various extraneous influences so as to help powerful socio-religious pressure groups and individuals. |